M&a Crm: Best M&a Crm Software for Dummies

Wiki Article

Getting My M&a Crm: Best M&a Crm Software To Work

Table of ContentsGetting My M&a Crm: Best M&a Crm Software To WorkM&a Crm: Best M&a Crm Software - The FactsThe 5-Second Trick For M&a Crm: Best M&a Crm SoftwareM&a Crm: Best M&a Crm Software for BeginnersWhat Does M&a Crm: Best M&a Crm Software Mean?

Some of the biggest corporate mergings in history can highlight the extent of these deals and also what companies stand to profit from going with the procedure. When mergings reach this range, governments obtain involved, as the splashing results of the merger can shake up entire economic climates. This merger placed 2 powerhouses together, as well as the new firm created the roadmap for making use of wire facilities to rapidly and also substantially improve internet access and efficiency.Originally, Warner-Lambert was preparing to sell to a various company, American Home Products. That bargain fell down, as well as Pfizer dove in to finish a merging of its very own. The merger experienced for $90 billion, as well as both business had the ability to combine profits for manufacturing as well as distribution of the cholesterol medication recognized as Lipitor.

M&a Crm: Best M&a Crm Software Fundamentals Explained

These were already two of the biggest oil refinery and also distribution business in the globe. Their merging combined those sources, and the impact was so excellent that it transformed the price of unrefined oil for life. That was really the inspiration for the merging, as it reallocated greater than 2,000 gas terminals across the U.S

The Disney as well as Fox merging was announced in 2019 to the tune of $52. 4 billion. The cost at some point increased to $71. 3 billion prior to the deal was finalized, making it among the biggest mergings in background. It likewise represented one of the largest sector consolidations ever before videotaped. Disney as well as Fox were already two of the three largest media web content owners in the world.

On January 4, 2022, Oracle revealed that it has actually become part of an agreement to acquire Verenia's Net, Suite CPQ company. This purchase will certainly bring Net, Collection clients indigenous configure, rate and also quote (CPQ) performance to make it possible for quick as well as exact led marketing. Verenia's non-Net, Collection CPQ as well as CRM product and customers are retained by Verenia LLC.

Not known Facts About M&a Crm: Best M&a Crm Software

Information Innovation (IT) is no much longer an expense facility or department for a lot of modern companies; it is the really core of a firm's method., we looked at how IT is a crucial to understanding the prospective worth drivers in mergers and also purchases (M&A).70-90 percent of mergers fall short to bring the value anticipated1. Half find here of the synergies readily available in a merger are strongly associated to IT3.

Getting The M&a Crm: Best M&a Crm Software To Work

Ensure you understand the framework and place of the information that will require to be transitioned. Assigning information owners by place and also data type (consumer, provider etc.) can frequently aid to make certain that nothing is missed out on. Ensure you have testing methodologies as well as standards concurred as you start the change to ensure a quality result.is altering the characteristics of M&A deals. IT used to represent a price that required to be managed as well as regulated as two organizations integrated. Today, IT anonymous and also electronic capabilities are commonly the driving force behind the deal. Also when a purchase facilities around a firm's various other eye-catching assets, electronic capacities can provide a significant source of additional deal value, particularly for legacy firms still battling to capture up to electronic citizens and also the even more technologically advanced and established gamers in their respective markets.

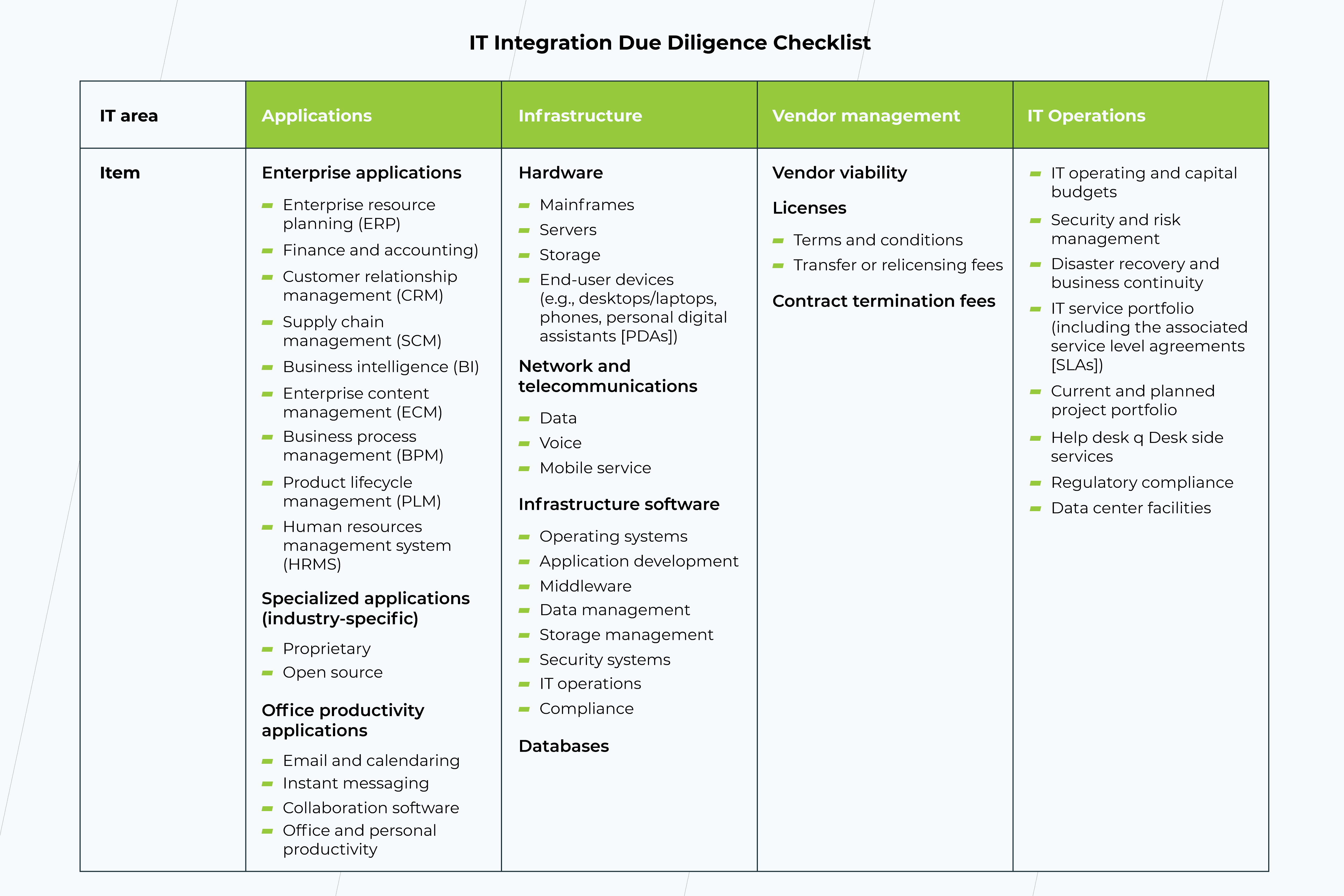

Along with modern technology value, acquirers have to likewise determine the possible innovation dangers as they perform their due diligence. Some businesses lug danger in the form of massive IT jobs that have capital funding devoted for years into the future (M&A CRM: best M&A CRM Software). Not only needs to a prospective acquirer evaluate business case for these jobs, but it must also assess the capacity of the company to provide versus the plan.

The Best Guide To M&a Crm: Best M&a Crm Software

In a recent deal Click Here in the chemicals industry, the acquisition target was a couple of months into a multiyear ERP upgrade, with the huge majority of the investment still to find. Had the appropriate due diligence not been done, the acquirer would have been confronted with a huge, unexpected hit to its financials.

Combination leaders need to function carefully with modern technology specialists and also organization or useful leaders to recognize where modern technology is required to satisfy the offer reasoning and to swiftly chart a program to integration. The integration plan will certainly be a clean-sheet strategy, lined up with all essential stakeholders, covering the end-state service, projects, resourcing, and also financial investments called for to supply the modern technology portion of the combination.

Report this wiki page